How to prepare the right Articles of Association for a CIC

With tens of thousands of CICs now registered and the rate of new registrations accelerating, we’ve been reflecting on the most common problem we encounter with our CIC clients: that they have chosen the wrong Articles of Association and/or not prepared the Articles of Association properly.

Honestly, it baffles us why the CIC Regulator never pulls people up on some of these issues when a CIC is first registered, but they don’t. Almost always we come across CICs with Articles of Association that have the guidance footnotes and square brackets left in and that are often also incomplete (square brackets in a legal document mean text that can be varied or needs to be completed - in all cases the text should be included/amended and the square brackets removed). In some cases we have come across a CIC limited by shares with Articles of Association for a CIC limited by guarantee or vice versa.

Which is the right kind of CIC for you?

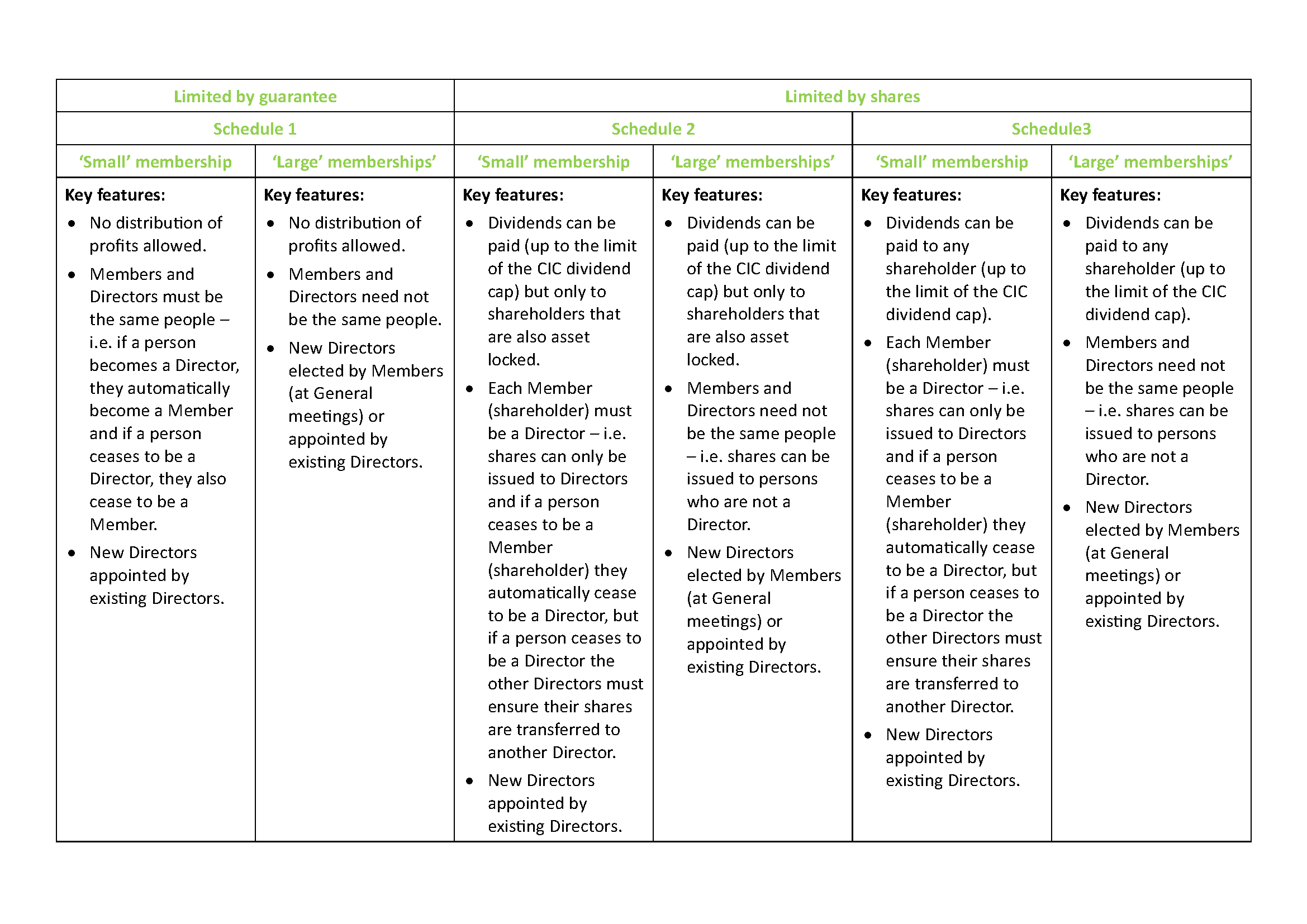

It appears to be a little known fact that there are six different types of CIC available under the regulations with model Articles of Association provided by the CIC Regulator. These are summarised in the table below.

The first, and most important decision to make is whether you want your CIC to be limited by guarantee or by shares. To decide this you need to consider if you want to be able to distribute some of the profits as dividends to the ‘owners’ (Members)? If so, you will need to choose a CIC limited by shares (currently CIC’s limited by shares are allowed to pay up to 35% of distributable profits in dividends). Once the CIC is registered it is impossible to convert between limited by shares and limited by guarantee.

We have written extensively in the past about the pros and cons of CICs and charities - see here and here - and we won’t rehearse the arguments again in this blog. For now, it enough to note that it is possible to convert any form CIC (limited by shares or guarantee) into a Charitable Incorporated Organisation. To find out more, read this blog.

If a CIC limited by shares is chosen, the next choice is whether to opt for Schedule 2 or Schedule 3 articles. If all the ‘owners’ will be asset locked bodies (CICs, charities etc) then a Schedule 2 CIC will be the right choice, otherwise it needs to be a Schedule 3 CIC. Note that if all the ‘owners’ of the CIC are charities it will probably be more tax efficient for the CIC to make donations to them instead of paying dividends so a CIC limited by guarantee may be a better option, with the charity ‘owners’ as Members of the company. It is possible, by adopting new Articles of Association, to switch between the Schedule 2 and Schedule 3 options for a CIC limited by shares.

A further factor is to consider whether your CIC will be fundraising alongside, or instead of, charging for services. If your CIC will be applying for grants, then a CIC limited by guarantee will be your best option but a Schedule 2 CIC limited by shares may be OK. This is because the grant funders that will fund CICs usually require the CIC to be either Schedule 1 (limited by guarantee) or Schedule 2 (limited by shares) because the profits either cannot be distributed at all or can only be distributed to other asset-locked bodies. They sometimes restrict funding to CICs limited by guarantee.

Having decided whether your CIC will be a Schedule 1, 2 or 3 CIC, the next choice is whether to choose ‘small’ or large’ membership. These terms are misleading. In practical terms they mean the following (see table above for more details):

‘Small’ membership means that the Directors and Members are always the same persons.

‘Large’ membership actually means that the Directors and Members can be different persons. This may be a large membership that elects Directors (e.g. an association) or a single Member (‘owner’) , for example if the CIC is to be a wholly owned subsidiary of a charity.

Most CICs are the ‘small’ membership option because it is simpler administratively and in terms of compliance (maintaining registers etc.).

It is possible, by adopting new Articles of Association, to switch between the ‘small’ and ‘large’ membership options (but not to convert between limited by guarantee and limited by shares).

How to prepare your CIC Articles of Association.

Once you have chosen the right Articles of Association option for your CIC, you can use the model documents provided by the CIC Regulator as a starting point for preparing your CIC’s Articles of Association. Unless otherwise indicated in the guidance notes in the model documents, these can be tailored to your needs providing they comply with all relevant laws. The text in red in the model documents cannot be changed (but you should make it black in your final document!). Make sure to delete all the guidance text in your final document, including footnotes, leaving only the text of the Articles of Association.

Text in square brackets should be adapted to your needs and the square brackets deleted. For example if the model document states the quorum for a meeting to be “[two]” you can change this to any number that works for you or keep it as “two” but without the square brackets. Note that if your CIC will have one Member, some of the provisions dealing with decision making by Members (including the quorum) will need to be adapted to make that work.

In various places in the model documents you will find a blank surrounded by square brackets, i.e. “[ ]”. This indicates you need to fill in the blank (and remove the square brackets). For example, the objects in the model documents read as follows: “The objects of the Company are to carry on activities which benefit the community and in particular (without limitation) to [ ].” You need to fill in the missing words. For example “The objects of the Company are to carry on activities which benefit the community and in particular (without limitation) to providing health advice and services for older people.” Note that you should not include objects that are exclusively charitable, otherwise your organisation should instead register as a charity.

Article 3.5 of the model document invites you to include details of another asset locked body that can benefit from donations from the CIC and that will receive any residual assets if the CIC is closed. If your CIC is to be a wholly owned subsidiary of a charity (or is to make donations to any other asset locked body), that charity/asset locked body must be specified here so that the charity can receive donations from the CIC and thereby reduce or eliminate Corporation Tax the CIC’s liabilities. You do not need to specify an organisation here but then Article 3.4 will need to be adapted. You could also adapt Articles 3.4 and 3.5 to specify more than one asset locked body. The Regulator’s consent will be required to make donations to any asset lock body not specified in the Articles of Association of the CIC.

How to make changes to your CIC Articles of Association.

You can alter your CICs Articles of Association through a Special Resolution of the Members of the CIC providing you retain the mandatory clauses (which are in red text in the model documents) and the revised Articles of Association comply with all applicable laws. The CIC Regulator provides a template Special Resolution you can use as a starting point.

The Special Resolution and revised Articles of Association must be filed with Companies House and the CIC Regulator. If you are proposing to change the objects of the CIC you must also submit a CIC14 form and a CC04 form.

Like this article? Join 250+ charity professionals receiving free monthly insights on governance, strategy and fundraising and much more.

Want to find out more? Contact us at julian@almondtreeconsulting.co.uk to discuss your organisation’s needs.